The results of the 2023 Brand Atlas survey form the basis of the report. Brand Atlas monitors and assesses the lifestyles of approximately 15.4 million economically active South Africans. These individuals are defined as those residing in households with a monthly income of more than R6,000, who are 16 years of age or older, and who have internet access to complete online surveys.

This year's survey shows slight changes in South Africans' retirement readiness and ability compared to the previous year's findings. The 10X Investments Retirement Reality Report 2023/2024 reveals that the majority of South Africans do not have a formal retirement strategy in place. Moreover, some planners lack confidence in their ability to support themselves in the long term amid inflationary pressures and economic conditions.

This comes as half (49.2%) of South Africa's adult population languish below the poverty line, according to the Department of Statistics.

Consumer confidence, as measured by the FNB/BER Consumer Confidence Index, has been negative since the last quarter of 2019. When COVID-19 hit, it dropped to an all-time high of -33 points and recovered to about -10 points in 2021, but it has declined. Again, he will hover around -20 points in 2022 and the first half of 2023.

Tobie van Heerden, CEO of 10X Investments, said the 2023/24 report showed that compared to the 2022 survey, more people recognized the importance of having a retirement plan in place. He said the number was found to be increasing.

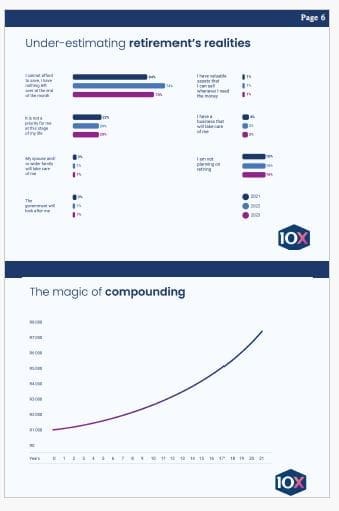

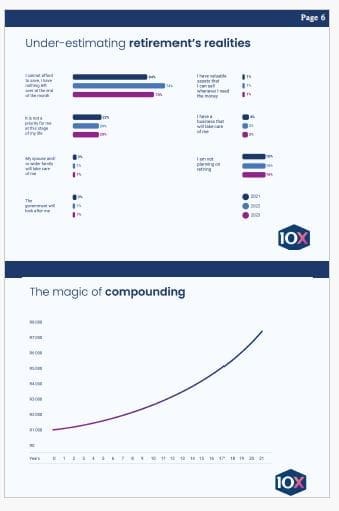

“The difference between what South Africans expect their retirement to look like and the reality faced by retirees and near-retirees cannot be underestimated. Knowledge and information are key to bridging the gap between expectations and reality – For long-term benefits, South Africans need to be better informed about the importance of saving, the power of compound interest, the consequences of not saving, and the additional disadvantages that women need to overcome and the challenges they must overcome. It’s a cost impact,” Van Helden said.

Post-retirement planning

About half of respondents who have retirement plans say they are “probably” or “definitely” on track with their plans, with some differences depending on age group. Notably, 29% of people over 50 said their plans were either “definitely not going as planned” or “probably not going as planned.”

According to 10X, it is very difficult to correct a savings deficit after age 50, and to retire comfortably, you need to invest at least 30% to 40% of your monthly salary in retirement savings. That's it.

Almost three-quarters (72%) of respondents whose plans are off track cite 'not being able to save enough' as the reason. This ties into the reason why you don't have a retirement plan in the first place. His 70% of respondents who do not plan agreed with the statement: “I can't afford to save. There will be nothing left at the end of the month.”

Van Heerden said the survey responses highlight the harsh economic realities for the majority of South African consumers.

“The proportion of respondents who partially or strongly believe they need to continue earning a living after their official retirement date is increasing year on year.”

Only 37% of respondents with a retirement plan could give a clear answer on the cost (as an annual percentage of assets) of their retirement investments. A further 37% did not know what the cost of the investment was. 13% believed that fees were based on performance. Meanwhile, 13% believed no charges had been filed at all.

women's economic health

For years, women have consistently rated lower than men on most indicators of financial well-being and retirement planning. Half of the women surveyed (49%) said they did not have a retirement plan, compared to 43% of men. More than twice as many men as women (11% vs. 5%) say they diligently follow a well-developed retirement plan.

Women are more likely to save than men (30% of women vs. 26% of men), and men are more likely to invest (24% of men vs. 14% of women). The report says that while prudent and prudent investment approaches are commendable, they ultimately disadvantage women because only high-risk investments such as listed stocks can outperform inflation over the long term. may result in

Due to stagnant GDP, large-scale layoffs, and the impact of the new coronavirus infection, more people are changing jobs. According to the 2023/2024 Retirement Status Report, 56% of workers who change jobs admit to having cashed out their retirement savings.

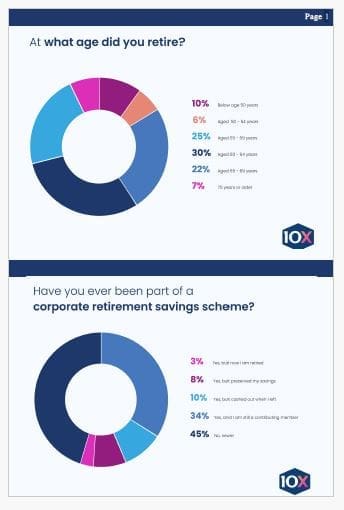

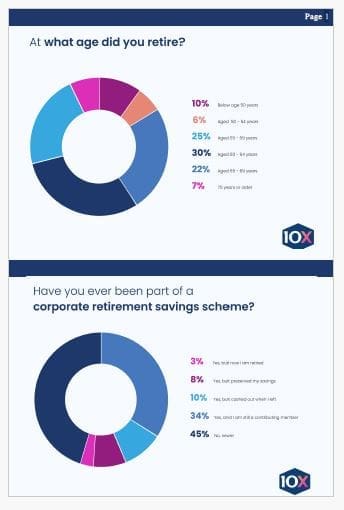

Voluntary retirement

Fewer people are able to retire on their own terms. In the 2021 report, this number was 70%. This year, that percentage has dropped to 60%, making it one of the most important statistics obtained in this study.

“This trend reflects the difficult economic times we live in,” Van Helden said.

Employers are forcing older workers to take early retirement packages. ”

Just over a third (35%) of retirees who are saving for retirement say they are “very” or “very confident” that their savings will last. Notably, 2% of retirees have already exhausted their savings, indicating they are relying on family or state support. 10X Investments (Pty) Ltd is authorized Financial Services Provider #28250 and S13B Pension Fund Administrator #24/444.