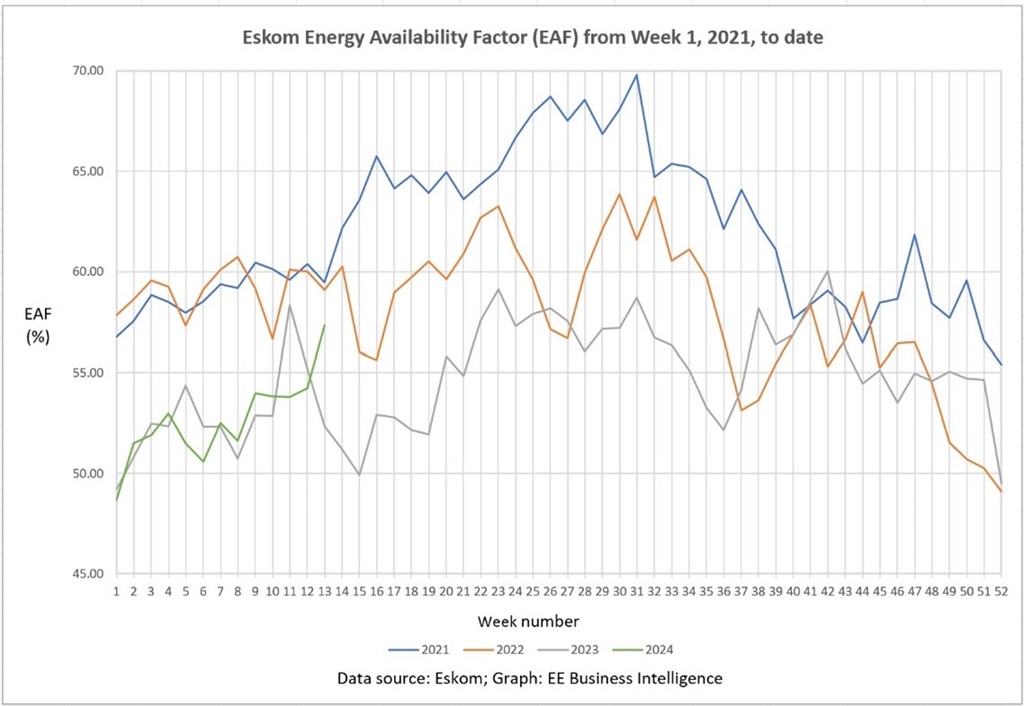

The energy availability factor for the Eskom fleet this year is similar to the same period last year.So why is load shedding decreasing this year? Ask Chris Yelland.

South Africa's electricity supply industry is in a state of flux, with the intensity and frequency of load shedding significantly reduced. Electricity customers may be wondering what's going on.

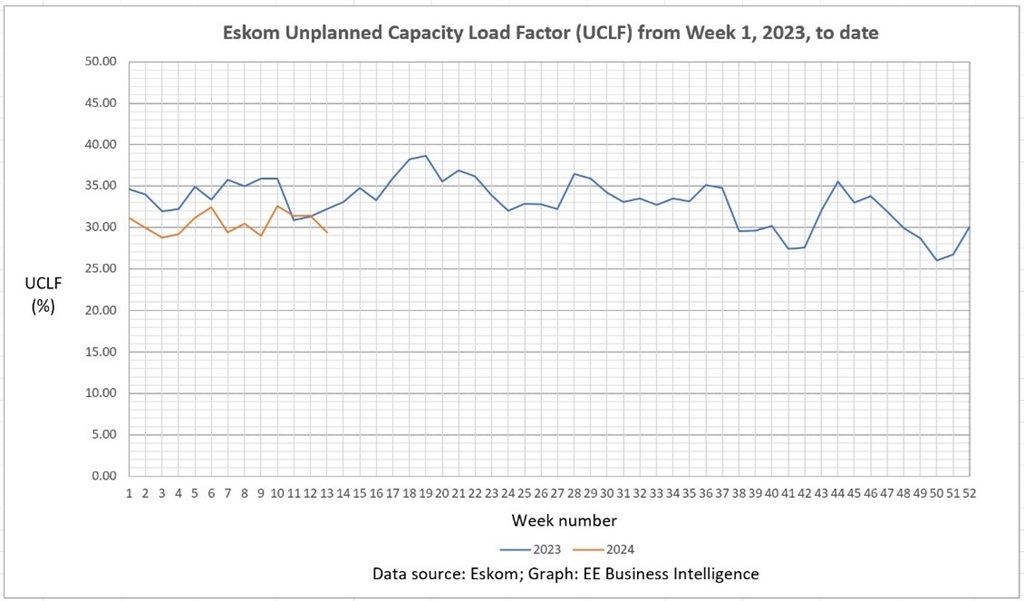

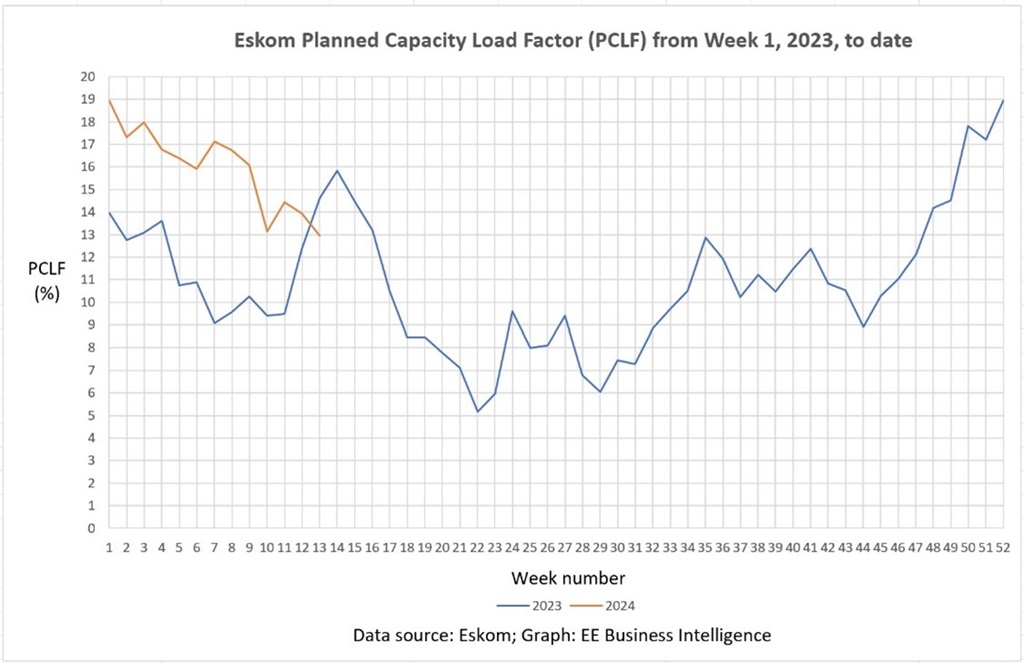

Unplanned failures (UCLF) are down this year compared to the same period last year (Figure 1), but this is offset by an increase in planned maintenance outages (PCLF) this year compared to the same period last year (Figure 2). Eskom Fleet (EAF) availability this year is therefore similar to the same period last year (Figure 3).

So why is there less load shedding this year compared to the same period last year?

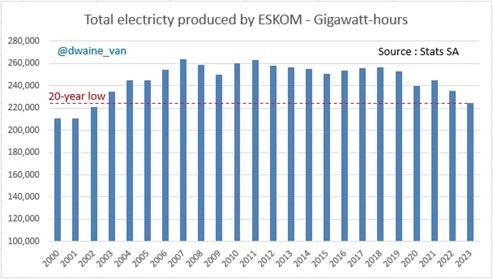

The answer is that demand for Eskom grid electricity continues to decline (Figure 4) for the following reasons:

- South Africa's economy is in a downturn and as a result overall electricity demand has remained roughly flat.

- Eskom and local electricity prices have soared over the years to two to three times the rate of inflation, reducing demand for Eskom-generated electricity.

- Load shedding and unreliability of Eskom and municipal power grids have negatively impacted electricity supply, particularly over the past four years.

- Electricity customers are responding by transitioning to captive power generation and alternative energy sources, including rooftop solar PV, battery energy storage, cooking gas, solar water geysers, energy efficiency, and overall reductions in grid electricity demand. .

- This trend is accelerating, with a pipeline of large-scale renewable energy and battery energy storage plants now being introduced into the power grid.

All of this has freed Eskom from a burden that it has struggled to cope with over the past few years, and as a result, the frequency and intensity of load shedding this year has been significantly reduced compared to the same period last year.

Therefore, Eskom says that the increase in Eskom prices and load shedding will cause customers to shift to alternative energy sources, reduce Eskom's sales volume and cause prices to rise to recover Eskom's fixed costs from the lower sales volume. I'm stuck in a death spiral.

At the same time, Eskom is also stuck in something of a debt spiral, which has been arrested for the time being by a government bailout from the national treasury, with large new debts by Eskom being suspended.

Death spiral and debt spiral for power companies, and the National Treasury is now forcing Eskom and the South African electricity supply industry as a whole to reorganize, unbundle and defund the private sector's role in financing, construction, operation, generation and transmission maintenance. is forcing an increase in South Africa's logistics infrastructure.

This should not be seen as a privatization of Eskom, but rather as increased public participation in Eskom operations by development finance institutions, commercial banks, pension funds, other financial institutions, businesses, industry and the general public.

The transmission sector has seen the establishment of the nominally independent National Transmission Company (NTCSA), the Independent Market Operator (IMO) and the South African Electricity Market. There could also be new high-voltage transmission lines funded, constructed, operated and maintained through public-private partnership (PPP) concessions (such as toll road concessions), as Eskom does not have the resources, funding or balance sheet to do so. Highly sexual. this.

In the power generation sector, Eskom and former Eskom generators, PPP generators, municipal generators, hundreds of independent power producers (IPPs) and literally thousands of large, medium and small 'prosumers' We are witnessing the emergence of a diverse and competitive power generation sector comprising: ” (i.e. electricity customers who are both producers and consumers of electricity).

Rather than purchasing power from its own generators or IPPs on its own, Eskom distributes power to a large number of customers across southern Africa's public grid between independent generators, generators and traders. There is a growing trend towards consignment and trading.

Fundamental changes are occurring as South Africa's power sector begins to catch up with that of many other parts of the world. This change is currently in progress, but is not a complete change. Fait accompli However, the situation could be reversed if domestic reactionary, backward-looking naysayers and “Dolittles” with vested interests in the failed status quo get their way politically.

But there are also reasons for optimism. The pace of reform in South Africa's electricity supply industry is currently fueled by the need for decarbonisation and security of supply, as well as the realities of economic imperatives.

Additionally, there is a growing multiparty consensus in Congress to pass the long-awaited electricity regulation reform bill. Once promulgated, the new Act will provide the necessary legal, policy, regulatory and planning framework for the anticipated reforms and South Africa's future electricity supply industry.

However, the necessary reforms to Eskom and the severely dysfunctional municipal and electricity distribution industries remain to be seen. This thorny issue has not yet been resolved.

Chris Yelland is a Managing Director at EE Business Intelligence. This article first appeared in his EE Business Intelligence and may not be published without the written permission of EE Business Intelligence.

newsArticle 24 encourages freedom of speech and the expression of diverse opinions. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.