Publishing Metaplatform Just days before the 20th anniversary of the founding of its flagship social network Facebook, the company announced its first dividend and reported higher-than-expected sales and profits thanks to strong advertising sales during the year-end sales season.

After the closing bell, the stock price soared more than 14%, increasing the company's stock market valuation by more than $140 billion, extending a long recovery and pushing Meta to its highest level in more than two years in recent weeks. .

After-hours profits alone were more than five times the overall value of social media rival Snap.

Meta, one of the tech industry's original unicorns, said the dividend will be $0.50 per share. The company also announced that it had approved an additional $50 billion in share buybacks.

The social media giant is the first of its generation of internet giants to issue a dividend, a milestone for a technology sector that has been dominated by the same few companies for more than a decade.

Founded in a college dorm room in 2004, the company has grown to become the world's largest social media company, connecting more than 3 billion people and helping them discover trends, communicate with their neighbors, and engage with politics. brought about a revolution.

The company, which owns Instagram and WhatsApp, has been accused of ignoring many negative aspects of its growth, including violating user privacy and inciting violence.

“Just keep building.”

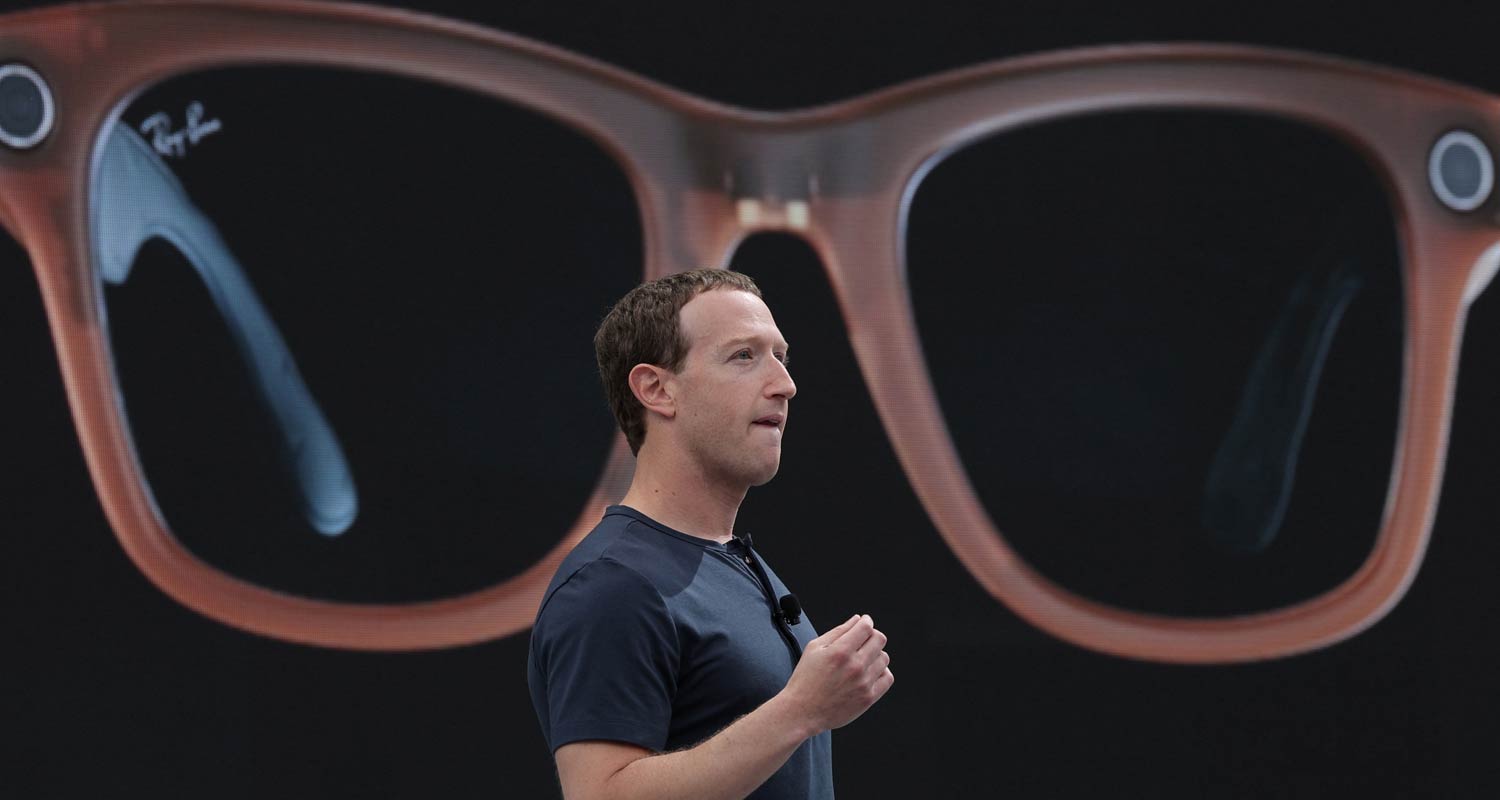

The day before the results were announced, CEO Mark Zuckerberg was called to testify before the US Senate about child safety online and was forced to apologize to the parents of sexually abused children. I no longer get it.

“It's not as good as people say when you're up and it's not as bad as people say when you're down. Just keep building good work over the long term,” he said Thursday on another app owned by Mehta. I mentioned it in a post on Threads.

Meta's stock price has risen steadily over the past year since the 2022 meltdown, when it wiped out more than three-quarters of its value, buoyed by investor excitement about artificial intelligence.

Read: Sheryl Sandberg resigns from Meta Commission

In addition to user growth and a rebound in digital ad sales, the company's fiscal austerity measures, which saw it cut more than 21,000 employees starting in the second half of 2022, also helped the company recover.

Fourth-quarter sales rose 25% to $40.1 billion, beating analysts' expectations of $39.2 billion, according to LSEG data. Net income rose more than 200% to $14 billion, or $5.33 per share, beating expectations of $4.97 per share, according to LSEG data.

“By nature and against expectations, this was one of our most impressive quarters,” said Evercore ISI analyst Mark Mahaney.

“By nature and against expectations, this was one of our most impressive quarters,” said Evercore ISI analyst Mark Mahaney.

The strong results come after fellow digital advertising giant Alphabet (Google) reported lower-than-expected holiday ad sales.

Improvements in its social media business have made investors more forgiving of Meta's continued spending as it pours billions into building its “Metaverse” technology and artificial intelligence infrastructure. On Thursday, executives doubled down on aggressive investments in both areas.

Zuckerberg reported that the company's metaverse-oriented Reality Labs division easily beat revenue expectations for the fourth quarter, posting record sales of $1.1 billion due to “strong sales” of Quest devices during the holiday season. He spoke to analysts after the book. Investors had expected $804 million, according to LSEG data.

Meta said it still expects operating losses to increase “significantly” as Reality Labs increases investments in augmented reality and virtual reality in 2024.

Mr. Zuckerberg said that while interactive and immersive experiences with these technologies remain the ultimate goal, the latest version of Ray-Ban smart glasses with built-in AI assistants is also gaining initial surprise among consumers. He said it was a hit.

“We thought we needed to build a complete display and hologram” before smart glasses became mainstream, he said. “And now it’s very likely that the built-in AI assistant will be the killer app.”

advertisement

Still, while Reality Labs' sales are improving, they still represent only 2.7% of the company's total sales.

“Meta ended 2023 on a very strong note, with revenues exceeding analyst expectations,” said Debra Aho Williamson, an independent technology analyst and former principal analyst at eMarketer. Ta.

“The company can talk all it wants about AI and the Metaverse, but it's still a social media company that makes almost all of its revenue from advertising, and it's clear that advertisers still love Meta.” — Katie Paul and Yuvraj Malik, Sheila Dunn and Noel Landewicz, (c) 2024 Reuters