Jeremy Hunt, the UK Chancellor of the Exchequer, is poised to table his spring budget as the country prepares for a possible general election this year.

Speculation that Chancellor Rishi Sunak believes the Chancellor of the Exchequer “lacks imagination” despite pressure from within his party to unveil a package of pre-election goods on Wednesday Mr Hunt promised to deliver a “responsible” budget.

Indeed, on Monday, the prime minister's press secretary was forced to deny allegations that Mr Sunak, who was prime minister from 2020 to 2022 during Boris Johnson's Conservative leadership, had deemed Mr Hunt a “coward”. lost.

“That's not the case,” the spokesperson said. “He is working very closely with the Chancellor to deliver our economic plans and clearly he will set out further measures in line with Wednesday's Budget.”

What can we expect from the UK budget?

What is your budget? Why is it important?

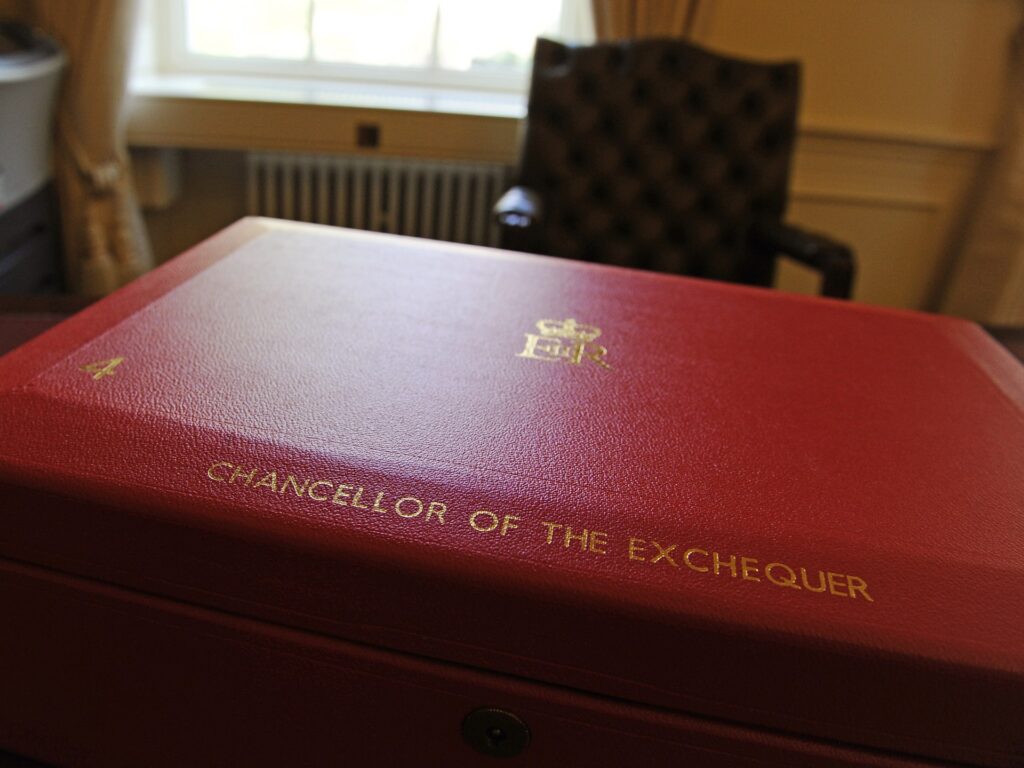

The UK raises and spends more than £1 trillion ($1.27 trillion) every year. Mr. Hunt therefore occupies one of the most important offices of the British state. The most public part of the Chancellor's job is to deliver the annual budget statement, which is usually tabled in the House of Commons in March, just before the end of the UK tax year on 5 April. Ru.

The budget includes the government's pledges to increase or cut taxes and outlines public service spending plans for the year ahead.

Scotland, Wales and Northern Ireland have their own devolved administrations, so not everything Hunt announced will apply to the whole country. For example, spending on defense affects the UK as a whole, but the education spending policy he announced applies only to the UK.

For example, the Scottish Government in Edinburgh runs Scotland's internal affairs through the Westminster Block Grant and has the power to change its own income tax levels. Members of the Scottish Parliament passed the Scottish Budget for 2024-25 late last month.

What is the current state of the UK economy?

The British economy fell into recession at the end of last year. However, Bank of England (BoE) Governor Andrew Bailey said in February that there were now “clear signs of improvement”.

Despite this, mortgage rates remain devastating for many UK homeowners as a result of economic decisions taken by former Conservative prime ministers Liz Truss and Kwasi Kwarteng less than two years ago. It is of a high standard.

Mr Sunak insists the UK economy is “on the right track” with central bank interest rates at a 15-year high of 5.25%.

Which parts of the budget will come under the most scrutiny?

According to reports, Mr. Hunt is considering personal tax cuts for working people. Mr Hunt is widely expected to cut National Insurance contributions, the tax that partially finances state benefits, by 2 percentage points. National Insurance payments count towards your entitlement to the National Pension in the UK.

But despite the Conservatives' instinct to boost economic growth through tax cuts, there are signs that the Chancellor, limited by fiscal constraints, will be able to make only modest changes.

“Tax cuts are a terrible thing for the conservative right,” James Mitchell, professor of social and political science at the University of Edinburgh, told Al Jazeera. “Every Conservative chancellor needs to either cut taxes, demonstrate their intention to do so in time, or explain why cutting taxes is not possible immediately.”

Last week, the Institute for Fiscal Studies (IFS) warned the government against cutting taxes that are not costly. Indeed, the specter of Mr Truss's disastrous reign as prime minister came to an ignominious end just 44 days after Mr Kwarteng's decision to pledge unfunded tax cuts in September 2022, leaving the UK economy in a slump. -Ominously hanging over Mr. Hunt.

“Mr. Hunt will be well aware that any bold move can backfire, as he did with great success under the Truss government,” Mitchell said.

“It is also clear that the Prime Minister is not from that faction of the party and, taking a long-term view, will go down in history alongside Prime Minister Kwarteng as one of the most fiscally foolish Prime Ministers of all time. He may be aware of what he doesn't want. A lot may depend on whether he tends to appeal to the core of the party or to a reputation for competence. do not have.”

Is this budget particularly important?

Having a general election so close means the budget is especially important. The upcoming general election must be held by January 28 at the latest.

Observers say the budget is a last chance for the Conservative Party, which is trailing the main opposition Labor Party by about 20 points in opinion polls.

So not only does this Budget offer the Conservatives an opportunity to appeal to voters through some kind of tax cut initiative, it also provides Hunt with an opportunity to jumpstart Labour's attacks.

What else will the Prime Minister announce?

According to reports, the Prime Minister could target two sources of funding proposed by Labor for a future UK government – the so-called “non-dom” status (where some UK residents, mainly the wealthy, have to pay tax). This is the abolition of the (used to avoid paying for) (money earned overseas) and expansion of windfall taxes on energy companies.

There is widespread speculation that Mr Hunt will include these Labor measures in Wednesday's budget in a bid to derail opposition spending plans and raise the money needed for personal tax cuts for Labour.