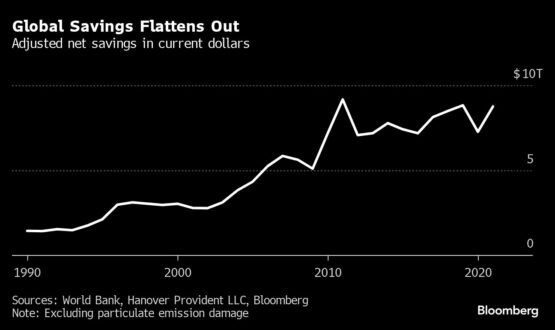

President Ben Bernanke's global savings glut is drying up. As a result, long-term interest rates around the world may rise.

An aging population, a struggling Chinese economy, and an increasingly fragmented global economy are among the factors that threaten to turn the savings surplus that the former Federal Reserve Chairman identified nearly two decades ago into a deficit. It is one.

advertisement

Continue reading below

According to some economists, the results are as follows. Borrowers below Washington were forced to supply dwindling surplus cash, reversing a decades-long trend of low interest rates.

Former European Central Bank President and Italian Prime Minister Mario Draghi said in a recent speech that “we are entering an era of intensifying geopolitical competition and more transactional economic relations” that are constraining the world's supply of savings. said. He said: “The downward pressure on world real interest rates that has characterized much of the globalization era should be reversed.''

In 2005, Bernanke argued that the world was awash in savings because China and other emerging economies were intentionally building up foreign exchange reserves as insurance against future financial crises. Thanks to high energy prices, oil-exporting countries have more money to invest.

The result is downward pressure on long-term interest rates around the world, including the United States. (Chairman Bernanke declined to comment for this article).

Data compiled separately by Hanover Provident founder Robert Dugger and Chicago Fed economists Robert Barsky and Matthew Easton suggest that the oversupply peaked several years ago. There is. But that impact was masked by the particularly accommodative policies the Fed and other central banks took to emerge from the 2007-2009 financial crisis. Then the pandemic triggered an even bigger outpouring of money from monetary and fiscal authorities struggling to keep the economy afloat.

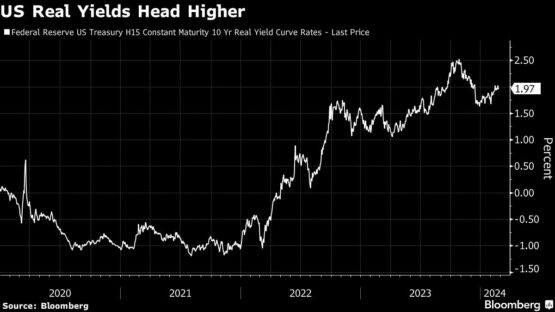

Now, as central banks scale back their intervention in global bond markets, the effects of the shrinking pool of savings are beginning to be felt. Julian Brigden, co-founder of Macro Intelligence 2 Partners, sees the rise in real yields and the rise in the “term premium” on U.S. Treasuries as a reflection of that phenomenon.

Brigden expects interest rates to rise in the coming years as an aging population draws down savings, and he calculates the fair value of a 10-year Treasury bond to be around 8% by around 2050, up from around 3% today. We expect it to rise.

“We think we're going to be a structural bond bear for the next 30 years,” he said.

“Politically Sustainable”

China's role as a major supplier of savings to the world may also decline due to pressure from the United States on various trade and technology fronts. The International Monetary Fund predicts that as the current account surplus shrinks, China's savings will fall from more than 44% of gross domestic product (GDP) last year to 42.4% in 2028 and 45.7% in 2022. I predict that.

Draghi told a meeting of the National Association for Business Economics on February 15 that a business and economic model like China's, based on large trade surpluses, “may no longer be politically sustainable.” “This change in international relations will have an impact on the global trade surplus.” Savings. ”

IMF First Deputy Managing Director Gita Gopinath warned of the risk of a new Cold War, this time pitting the world's two largest economies, the United States and China, against each other.

advertisement

Continue reading below

“As geopolitical risks increase, threats to the free flow of capital and goods are increasing,” he said in a speech in Colombia in December.

Draghi insisted there would be an emphasis on coordination between fiscal and independent monetary policymakers, something previously seen only in economic emergencies like the pandemic.

In an environment where savings are scarce, governments seek to finance ambitious programs such as the transition to net-zero carbon emissions, while central banks are wary of the risk that such spending increases could trigger an explosion of inflation. Dew.

The desirability of such increased collaboration extends to the world's largest economy, where rising yields have already pushed interest costs for governments to record levels.

“In a world of increasing competition for limited savings, success will require the Fed and Congress to pay attention to global savings availability and work together openly and continuously,” Dugger said. Ta.

Not all economists are convinced that the global economy is entering a new era of rising interest rates. Yes, society is aging. But people are also generally living longer. Former IMF chief economist Maurice Obstfeld said this would encourage older people to tap into their savings more wisely and younger people to save more for retirement.

Fed policymakers are starting to consider the possibility that the so-called neutral interest rate — an interest rate that neither stimulates nor restrains the economy — could be higher than it was before the pandemic. But their focus is primarily domestic, as they ponder the resilience of U.S. economic activity in the face of sharply rising interest rates.

Dugger argues that we can't ignore what's happening around the world.

“The Fed won't be able to push U.S. interest rates below world levels without risking higher inflation. 'High for an extended period of time' means what the Fed says.” .

© 2024 Bloomberg