(Javier Guerci/Getty Images)

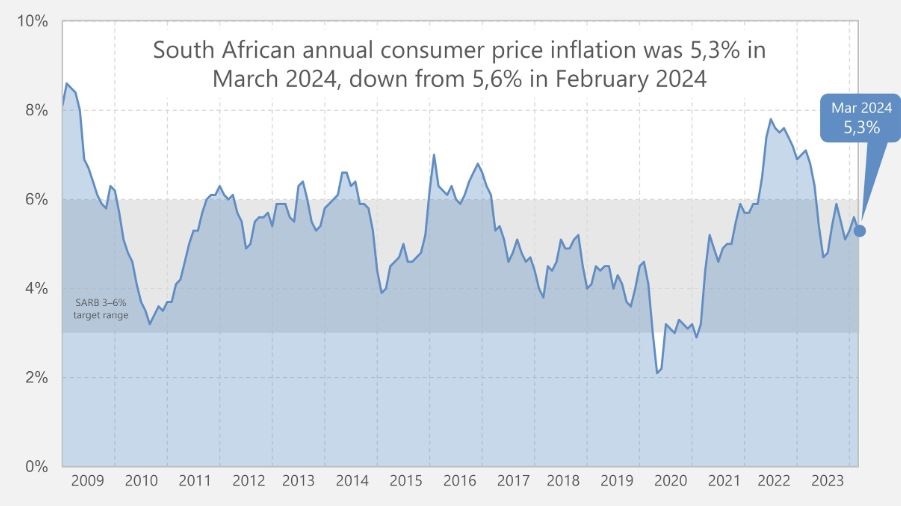

Annual consumer price inflation slowed for the first time this year, falling to 5.3% in March from 5.6% in February and lower than some economists expected.

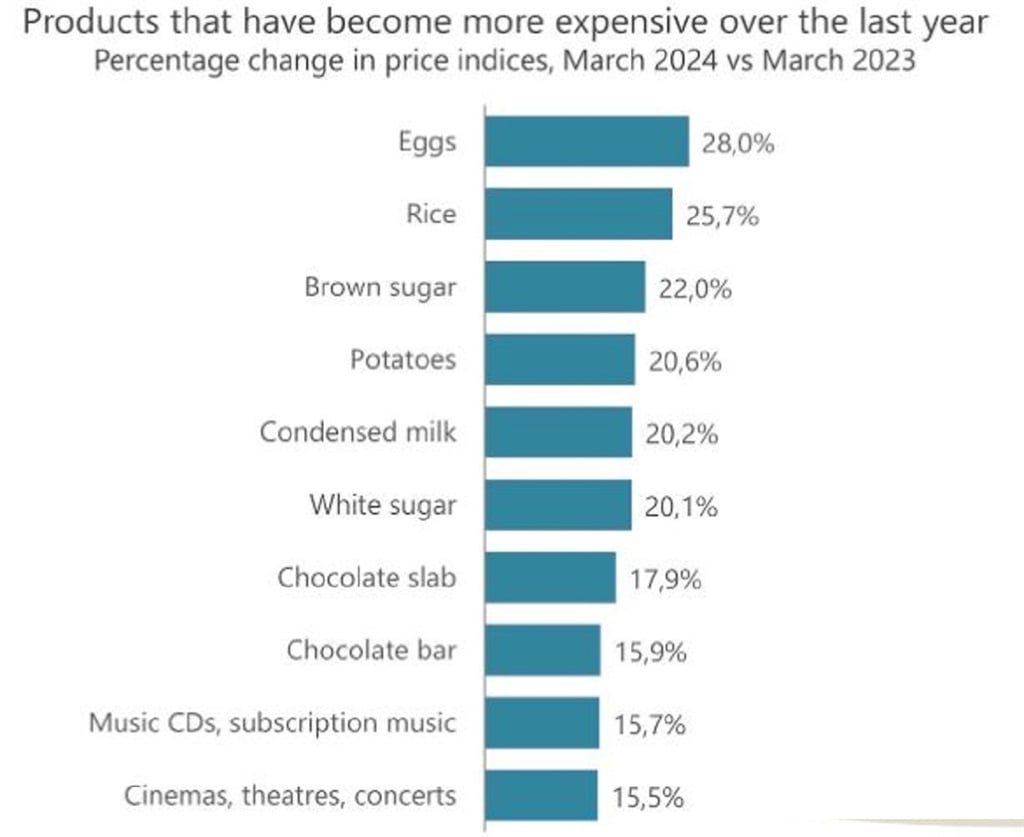

The decline slowed food and non-alcoholic beverage prices from 6.1% in February to 5.1% in March, far from the peak of 14% in March last year, the statistics agency said. The annual growth rate for products in this category was also the lowest since 3.8% in September 2020.

Bread and cereal inflation slowed to 5.0% from 6.1% last month. It previously hit a dizzying high of 21.8% in January 2023, according to the Bureau of Statistics. Bread flour, pasta, rusk, corn flour, ready-mix flour and white bread were all cheaper than a year ago.

“Meat inflation also slowed in March due to falling beef and mutton prices,” the agency said in a statement. “The annual rate of meat inflation in March was 0.8%, compared to the recent peak of 11.4% in February 2023. %, it was significantly lower than that.”

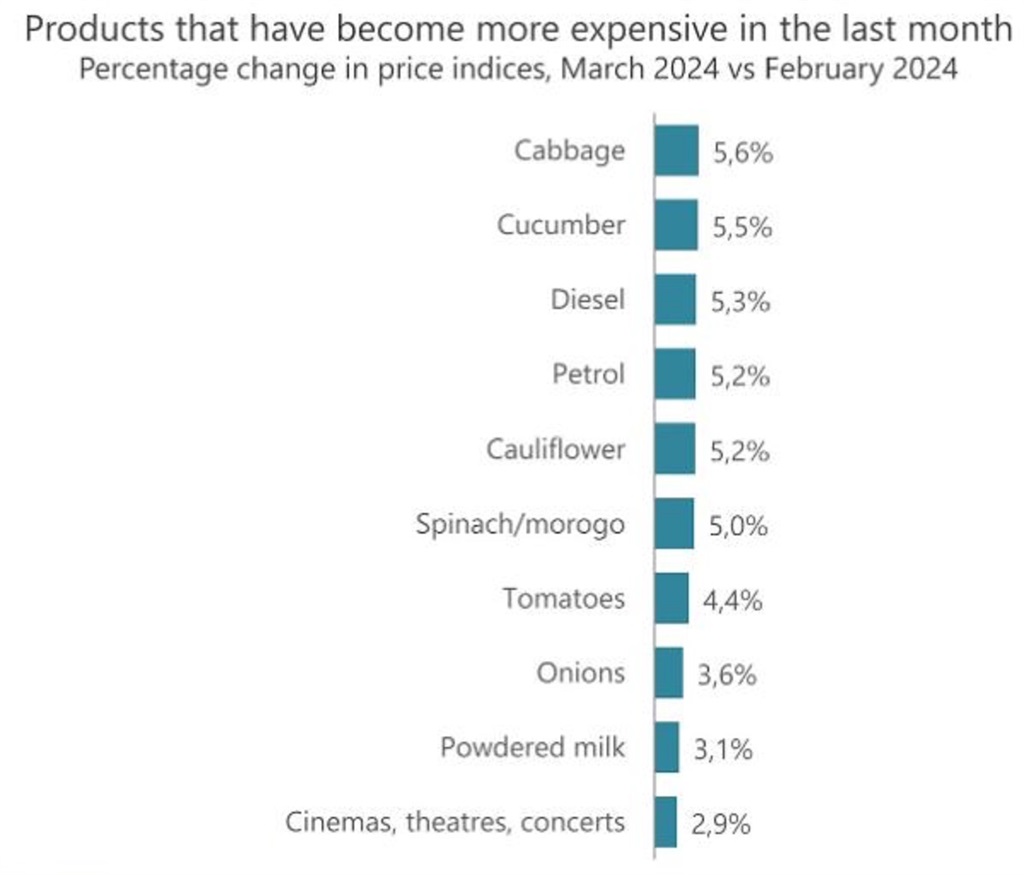

The Consumer Price Index (CPI) increased by 0.8% from the previous month.

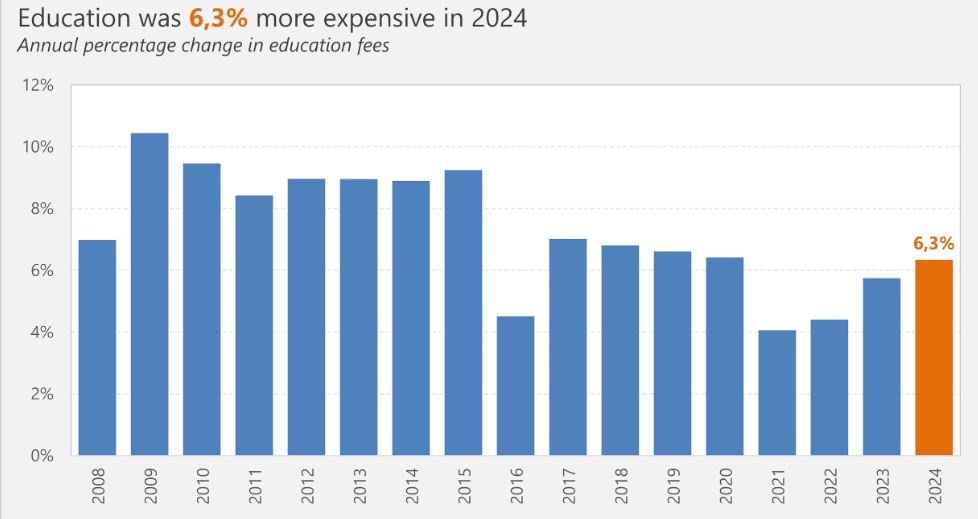

Education expense surveys are conducted once a year in March. Education costs in 2024 will rise 6.3% from a year ago, the highest rate of increase since 6.4% in 2020.

Although inflation has fallen year-on-year, this figure remains above the South African Reserve Bank's (SARB) target midpoint of 4.5%. The central bank has vowed not to cut interest rates until inflation is consistently near the middle of the 3-6% range.

Read | In the interest of the poor: SARB defends inflation stance as situation worsens

Nevertheless, FNB said signs of consumer distress gave the Monetary Policy Committee (MPC) a compelling case for cutting interest rates earlier, ensuring that its measures maintain stability and slow the business cycle. He claimed that it would be promoted.

The FNB said: “Although inflation may have peaked, the ongoing disinflationary trajectory remains unstable and highlights significant upside risks, and the MPC remains cautious to avoid premature rate cuts. We need to pay attention.” “However, extending rate cuts longer than necessary, especially when broader financial conditions are already constrained, could further constrain growth and increase the likelihood of a technical recession.”

Late last year, SA narrowly escaped a technical recession, defined as two consecutive quarters of contraction in gross domestic product (GDP). GDP in the fourth quarter was just 0.1%, and economic growth in 2023 was recorded at 0.6%.

Many economists say interest rate cuts could begin in September or November, and rising gasoline prices due to escalating conflict in the Middle East mean upside risks to the inflation outlook remain. Says.

Read | Economists warn interest rate cuts are likely to be delayed until late 2024 due to fuel price fluctuations

The next MPC announcement is scheduled for May 30th.