The annual consumer price inflation rate slowed for the second consecutive month, from 5.3% in March to 5.2% in April.

Although April's results were lower than economists had expected, South Africa's consumer price inflation rate has not fallen below 5% since August last year, and even then it will only be below 5% for all of 2023. It was only a month.

According to the Bureau of Statistics, the main drivers of inflation were housing and utilities, miscellaneous goods and services, food and non-alcoholic beverages, and transportation.

“The annual inflation rate for food and non-alcoholic beverages further slowed from 5.1% in March to 4.7% in April, the fifth consecutive month of decline. In the subcategory, the annual inflation rate fell.Fruits and hot drinks,'' the statistics office said.

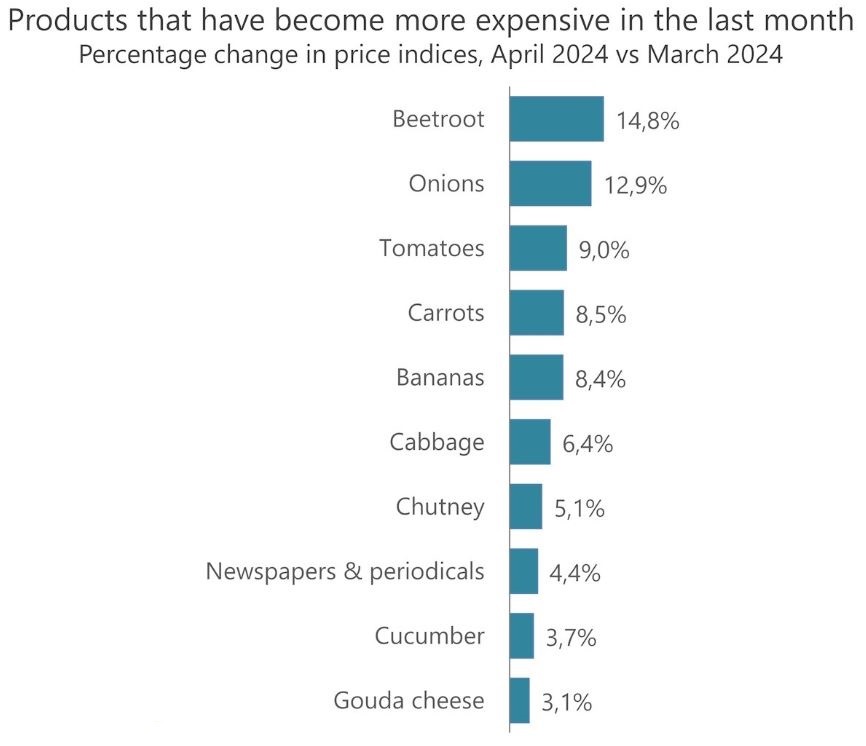

Vegetable prices rose an average of 7.4% in the 12 months to April, surpassing the 6.0% increase recorded in March.

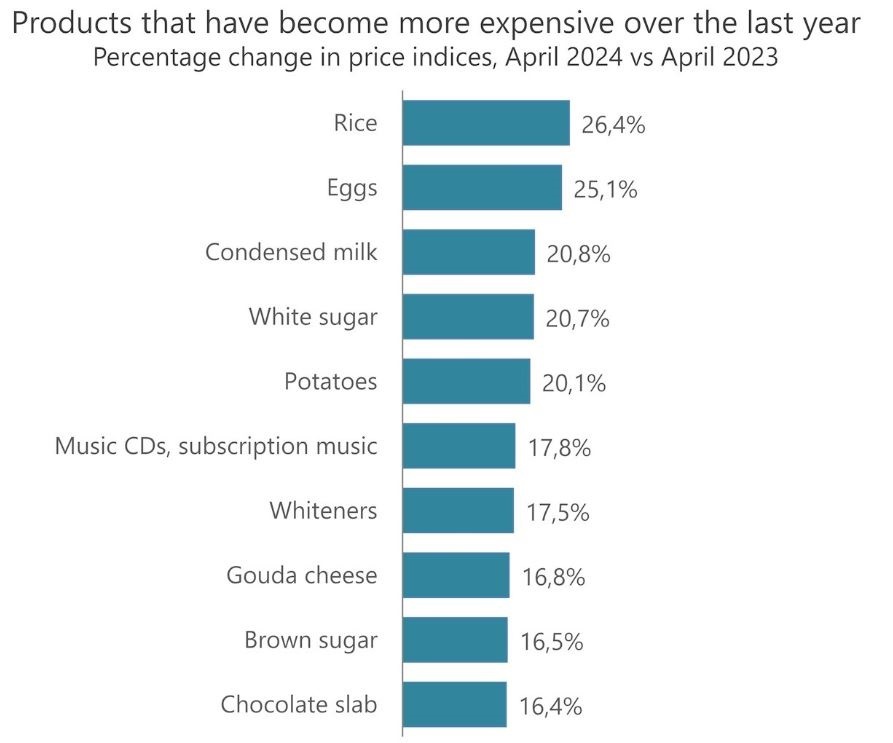

Annual inflation for sugar, confectionery and desserts, although still high, fell to 16.8% from 17.8% in the previous month. Inflation rates for products such as white sugar, brown sugar, chocolate and jam remain high, with egg inflation peaking at 39.9% in November and declining for the fifth consecutive month after falling to 25.1% in April. did.

According to the Bureau of Statistics, fuel prices rose by 1.9% for the month, increasing the annual rate to 9.0%.

read | Potential good news: Fuel prices on track for lower prices in June

At the beginning of May, gasoline prices rose by 37 cents per liter, the highest level in seven months. However, the price of 95 unleaded petrol is expected to fall by about 62 cents per liter, according to recent estimates from the Central Energy Fund, and the wholesale price of diesel could also be cut. However, conflicts in the Middle East continue, the rand is unstable, and final fuel prices for June will only be determined at the end of May.

The Consumer Price Index (CPI) increased by 0.3% from the previous month.

read | In the interest of the poor: SARB defends inflation stance as situation worsens

The South Carolina Reserve Bank has vowed it will not consider cutting interest rates, which are at a 15-year high, until consumer inflation is more consistently near the midpoint of its target range of 4.5%.

This attitude, rising fuel costs and stagnant inflation raise the risk that interest rates will not be cut this year.