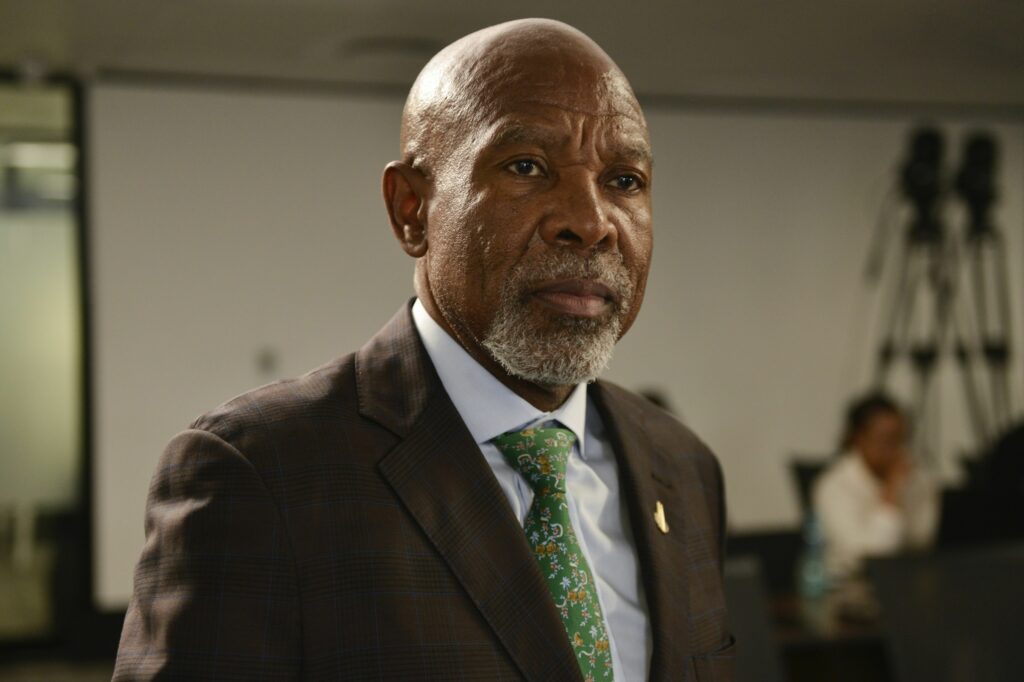

South African Reserve Bank Governor Lesetya Kganyago has defended the financial authority's independence in the face of repeated calls for more powers ahead of elections this year.

“Central bank independence came about because we tried to depend on the central bank and it didn't work,” Kganyago said in a speech posted on the central bank's website. “In countries where central banks are tied to the political process, they tend to be more willing to fund whatever the government wants, or to adjust monetary policy around election dates,” he said. .

advertisement

Continue reading below

The governor said these changes would “incur significant costs to the economy, paid for through inflationary taxes that are disproportionately imposed on the poor and vulnerable members of society.”

The African National Congress said it wants the central bank's mandate to be expanded to boost the economy and boost employment, in addition to its existing mandate of meeting inflation targets. The party is expected to face its toughest elections this year since it came to power in 1994. The voting date has not yet been announced, but it must take place by the end of August.

Read: ANC wants to expand Sarb mandate

Mr Kganyago regularly defended the Reserve Bank's mandate to achieve price stability, stressing that it was enshrined in South Africa's constitution. He said last week that expanding the scope of his mandate to cover jobs and economic growth would not solve the country's structural problems.

“Without electricity, you don’t have that kind of growth,” he said. “If the logistics system is not working and the mines are digging things out of the ground but they are not able to get the iron ore, coal, manganese to the market, then the mines cannot expand because the national logistics system is not working. Not possible. The central bank's mandate will solve those problems. We must act in sync.”

Read: Why nationalizing Saab won't work

advertisement

Continue reading below

South Africans endure near-daily power outages after years of neglect and mismanagement have left the state-owned power company Eskom unable to keep up with demand. Transnet, which operates ports and freight trains, is also beset by a myriad of problems, the combined woes of which are dampening economic activity, accelerating inflation and sluggish consumption.

At its last meeting, the central bank's Monetary Policy Committee unanimously voted to keep the benchmark interest rate unchanged for the fourth consecutive time at 8.25%, the highest level set in 2009.

Before pausing in July, the central bank had raised interest rates in 10 meetings to keep inflation above 4.5%, the midpoint of its target range, where it wants to keep expectations fixed. Kganyago said the MPC would not cut interest rates unless inflation fell sustainably towards the midpoint of the target band.

© 2024 Bloomberg LP