Globally, weather-related events can trigger insurance crises.In South Africa, insurers are preparing for the impact., write Ronald Richman.

A number of weather-related disasters have occurred in recent years, particularly in the last year, that have shaken the foundations of the insurance market and signaled that disaster is imminent. If things fall apart, can you expect insurance to pick up the pieces?

The ominous groans of climate change are reaching the insurance industry, and the predictions are alarming.

Globally, weather-related events can trigger insurance crises. In South Africa, insurance companies are bracing for the impact.

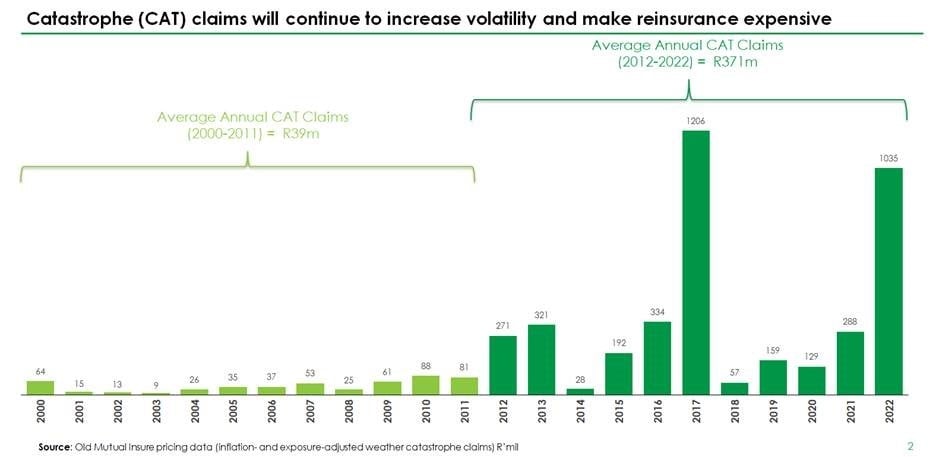

Although the country was previously a major catastrophe (CAT)-free region, the scale and scope of recent disasters means that the CAT situation is now undergoing a dramatic change.

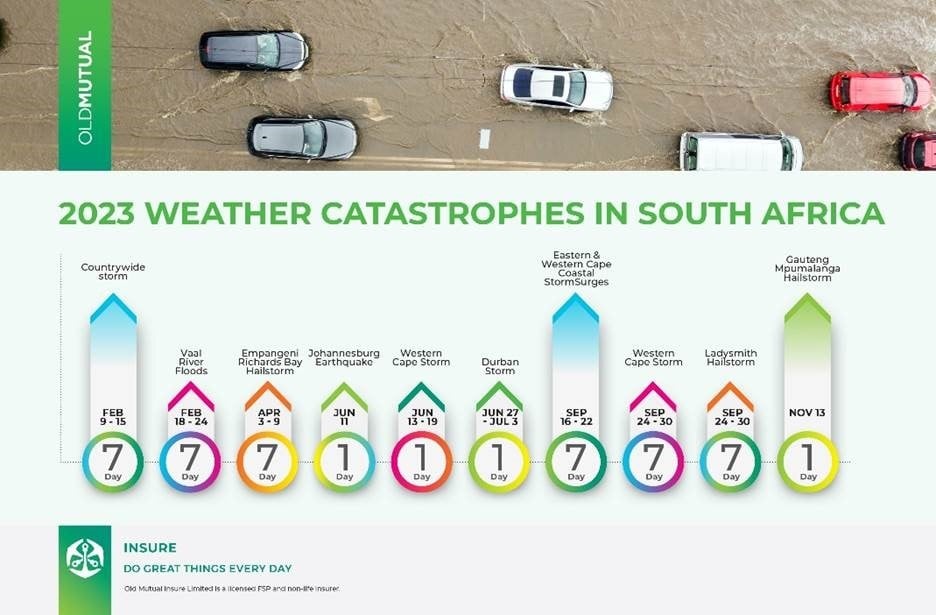

In 2023, Old Mutual Insure recorded 10 weather-related insurance claim incidents, three of which were serious and amounted to millions of rands. This includes the Western Cape storm in June and his Heritage Day weekend in September, as well as hailstorms in Gauteng and Mpumalanga in November.

This is not a phenomenon limited to South Africa. Globally, adverse weather conditions are impacting the sustainability of the insurance industry in new and unexpected ways. Global data shows that the main cause of CAT losses is severe convective storms, accounting for 68% of global insured natural catastrophe losses in the first half of 2023.

According to Swiss Re Group's Sigma Publications, severe thunderstorms in the United States during the same period resulted in insured losses of $34 billion, approximately 70% of total CAT insured losses. This represents an unprecedented level of economic damage in such a short period of time.

Previously, a single large event such as a hurricane or earthquake was often responsible for record CAT losses, but 2023 data suggests that last year's main problem was smaller events. are doing. This was also the case in the South African environment.

Read | 2023 will be the hottest year on record, with temperatures approaching the critical 1.5°C – Climate Monitor

In addition, 2023 was the hottest year on record, with continued heat waves driven by climate change and temperatures further amplified by El Niño, a naturally occurring climate phenomenon that occurs every two to seven years, and other cyclical weather events. .

Some experts believe that by 2023, the U.S. economy will be as overexposed to climate risks as it was in 2008, when it was overexposed to mortgage risk, which was a major cause of the then-catastrophic financial crisis. He said he was overexposed.

Given this context, it is not far-fetched to think that climate change could destabilize the global insurance industry, with knock-on effects for South Africa.

Signs of stress are already showing in some parts of the country, with companies withdrawing coverage from California and Florida.

Structural changes in the reinsurance market have further complicated the challenges, including:

While many of the recent events are not unprecedented, insurance companies have experienced particularly severe losses that have hit their earnings and capital reserves. This is because reinsurers are exposed to significantly less risk from this type of event, and insurers are no longer able to smooth out losses over time.

In 2023, reinsurers once again ranked climate change as the most significant risk facing the sector, according to a study conducted by PwC. Moody's said reinsurance companies are feeling the pinch as losses from their insurance customers pile up. To combat this, many companies are raising prices, limiting coverage, and even exiting some markets to improve profits.

This structural shift in the reinsurance market has far-reaching implications and requires a fundamental reassessment of how the market approaches risk and pricing.

Contrary to popular belief, the traditional lines of business in the property and casualty insurance industry have low profit margins. This, combined with inflationary pressures and the convergence of losses from the CAT event, means we are in a pressure cooker and ready to bubble over soon.

For insurance to be sustainable, it must charge appropriate prices for coverage that reflect the true cost of risk in today's volatile climate. Otherwise, confidence that the insurance system will exist when things break down is at risk.

Funding the level of coverage that policyholders have historically enjoyed will likely require price increases over time to compensate for these losses. This needs to be done in a way that reflects the true risks posed by each policy.

Read | Lightning strikes kill more than 260 people a year in the south-east, but the Bureau of Meteorology says a new French partner can help.

This is not all bad news, as sophisticated modeling techniques and innovative solutions are being explored to better quantify rising climate risks. These should help you get through this turbulence.

In early 2024, Old Mutual Insure will launch an innovative new approach to capturing climate change data and aligning this with the insurance policy experience to bridge the gap between forecasting and pricing weather-related risks. announced. This is the first project of its kind in South Africa to overlay climate and claims data.

But collective action is essential.

Mitigation efforts are essential. Education is key, as consumers need to understand the importance of climate risk management and asset protection.

Additionally, public-private partnerships can help address insurance gaps in local markets and spread risks more equitably. Currently, there is no structure for this type of solution, unlike in other parts of the world where this type of solution has been successfully implemented.

For example, Flood Re, the UK's flood reinsurance scheme, is a joint initiative between the government and insurers to make flood cover more affordable.

A similar approach is warranted in South Africa, where structural deficiencies have exacerbated the gap between the insured and the uninsured.

The South African insurance industry has the breadth and depth of knowledge, skills and desire to help bring solutions to problems. Ultimately, this will reduce the burden of the catastrophe on all South African stakeholders.

Ronald Richman is Old Mutual Insure's principal actuary.

News24 encourages freedom of speech and the expression of diverse opinions. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.