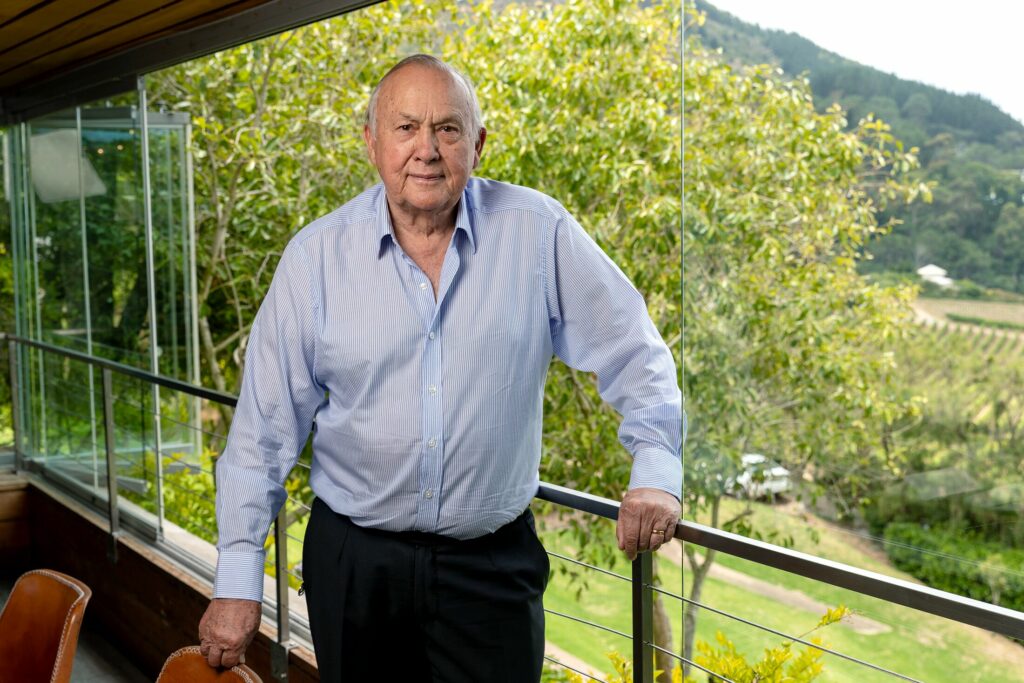

South African billionaire retail tycoon Christo Wiese intends to return to the future.

The 82-year-old serial investor who led the expansion of Africa's largest clothing retailer and the continent's largest grocery store has dived into a reminder of the beginning of his storied career nearly half a century ago: diamonds.

advertisement

Continue reading below

“I've always been fascinated by diamonds, because it's a wonderful industry where you wander around and then one day you come across a big stone that changes your whole life,” says Beau Constant. Mr. Wiese said over lunch in the summer green vineyards of Shea. A wine farm in Cape Town. “This Atlantic region produces some of the highest quality diamonds in the world.”

According to this theory, the movement of the Kaapvaal Craton and continental plates more than 2.5 billion years ago transported diamond-bearing debris down South Africa's Orange River to the continent's southwestern coast. Mr. Wiese dreams of finding “the big thing” here, and in recent years the racketeering millionaire has come to spend at least part of his eight-hour workday on his mining operations, which He says it's already profitable. A $10 million pink diamond.

Trans Hex Group, the mining arm that Wiese owns with his son-in-law, plans to explore other popular minerals and metals over time, including phosphate, lithium, gold and platinum. The company has four large ships equipped with equipment that can search for these treasures by sucking up gravel from the ocean floor and processing the tailings onboard before dumping them back into the ocean. A state-of-the-art diamond recovery vessel could cost him as much as $420 million.

The tycoon, who has a net worth of $1.2 billion, according to the Bloomberg Billionaires Index, is worth $7 billion after losing a significant portion of his fortune in the 2017 explosion of furniture store chain Steinhoff International Holdings NV. It has decreased since then, but I am very aware of what I am taking on.

Mr. Wiese first became interested in alluvial diamonds in 1976, when he purchased a mine along the Orange River. It was the country's largest after the company owned by De Beers, part of Anglo American, the world's top diamond producer, which also mines in Namibian waters.

It was “a very exciting proposition,” Wiese said of the first venture. He sold after about five years because he wanted the money to buy control of Pepcor, the clothing chain that became his biggest asset.

Industry insiders say Wiese's renewed passion for diamond mining could be riskier than any bet in the retail industry, and that his desire for adventure remains strong even after getting badly burned investing in Steinhoff. He said that this shows that he has not lost his true identity.

David Shapiro, chief global equity strategist at Safin Securities, who has 52 years of experience at the Johannesburg Stock Exchange, said: “South African mining is made up of pioneers, but this type of mining is not easy. At best, we get only a patchy profit.” “He has enough money to do what needs to be done, so perhaps he's willing to take on riskier ventures.”

The son of a sheep and cattle farmer in the remote, desert-like northern city of Upington, Wiese earned a law degree from Stellenbosch University in 1967 before joining Pep. Pep was founded two years earlier with his one store located in a rural railway. town. He briefly left the firm to pursue his law practice and ran unsuccessfully for Congress on the Progressive Federalist Party.

Returning his focus to Pep, he became the company's largest shareholder and chairman in 1981, changed its name to Pepcor, and helped oversee an aggressive expansion drive. Pepkor acquired retail chains Smart Group Holdings, Cashbuild, Checkers and Stuttaford in 1991, and in the same year made its first overseas expansion, opening the Your More Store outlet in Scotland.

Mr. Wiese spent 35 years building Pepcor into a formidable company with operations across Africa and Europe, spinning off Shoprite Holdings and expanding it to become the continent's largest grocer. Shoprite remains his star investment.

In 2014, he traded $2.5 billion of Pepcor stock for Steinhoff stock. Three years later, after accounting fraud was discovered, auditors refused to approve Steinhoff's financial results, and the stock price fell by about 90%. It was later revealed that management had significantly inflated profits. Wiese denied knowing of any wrongdoing.

Wiese, a lively octogenarian, maintains a wide range of interests. While he's deep into the nitty-gritty of retail, he also discusses the debate about allowing more South Africans to own land, the importance of the books he's reading, and the loss of community style in Europe. He is known for being able to jump into anything, right down to the reason. Lifestyle has a negative impact on the economy.

The entrepreneur still drives his Lexus Land Cruiser from his home in Cape Town's seaside neighborhood of Clifton to his office, where he oversees his various businesses. These include gym chain Virgin Active and South African food manufacturer Premier Group. He has also recently invested in a medical malpractice insurance company.

Despite his established family office, Wiese says he has no plans to retire. He wants to continue working and staying active, and his two ambitions for 2024 are to open his 4,000-hectare (9,884-acre) Lawrenceford wine estate near Cape Town in January. One visit and more trips to a private wildlife sanctuary in the Kalahari Desert. More than a few times this year, he said.

advertisement

Continue reading below

“A lot of people probably think I'm crazy for still coming into the office every day and sitting there,” he said. “But I think that while you're alive, you should be active and be a part of your life. And even as we sit here and sometimes we're really struggling with the challenges, we should still be active and be a part of our lives.” enjoying.”

This includes operating in countries where gross domestic product growth is less than 1%, inflation is 5.1%, and unemployment is nearly 32%.

Wiese, like many South Africans, is following the country's politics closely ahead of this year's election, which is expected to be the most important since the end of apartheid 30 years ago. He expects the ruling African National Congress to face the toughest challenge since it began governing the fledgling democracy in 1994.

This will be a “good change”, he said, adding that with all of South Africa's problems, there is no other place he would rather live. His three children all live near him.

Still, the country's economic woes have led to a plateau in revenue growth for the country's retailers, and these companies are hoping to capitalize on this by gaining a larger share of the local market through digitalization drives. Trying to reduce restrictions. Wiese said Shoprite is becoming almost a “digital business with a grocery store attached.” The company's Checkers Sixty60 is South Africa's first one-hour grocery delivery app, with such items accounting for more than three-quarters of the country's on-demand delivery spending.

Checkers Supermarket at Rosebank Shopping Mall, Johannesburg, 2022. Image: Waldo Swiegers/Bloomberg

The offshore diamond mining business, although not without its own risks, has provided further diversification. Gemstone prices have been cut this year as suppliers try to revive sales while production costs remain high. Apart from expensive ships, offshore miners typically claim mining areas of hundreds of square kilometers and require specialized crews who stay on board for weeks at a time.

Scientists concerned about environmental issues have also voiced opposition. Iona Blair said the impacts of ship mining remain largely unknown and “without dedicated monitoring and ecological impact assessments, it is very difficult to detect impacts on the marine environment.” This was stated in a paper published by the University of Cape Town. Many people along the west coast of Namibia and South Africa make their living from fishing.

Norway's recent decision to allow seabed mining exploration in its waters has led to calls for a moratorium on such activities until regulations for mining on the high seas are established.

However, compared to Norway, the work Trans Hex is doing is in relatively shallow waters. Scientists contracted by Trans Hex concluded that some disturbance of the ocean floor, which has remained untouched for millions of years, does no harm. The company also employs several hundred people and brings in foreign exchange through diamond sales, Wiese said.

“Overall, we think that's a positive,” he said.

© 2024 Bloomberg