The Institute for Global Dialogue (IGD) says “wasted opportunity” is the word that best describes the untapped potential of cooperation between Africa's two largest powers, Nigeria and South Africa.

The IGD notes that the contest for Africa's potential seats on the United Nations Security Council (UNSC) is “a major source of contention between South Africa and Nigeria.”

As Africa's most populous country, Nigeria's permanent seat on the Security Council would better represent the continent.

Similarly, a seat for South Africa, Africa's most economically developed country, could mean increased economic potential for UN operations in Africa. ”

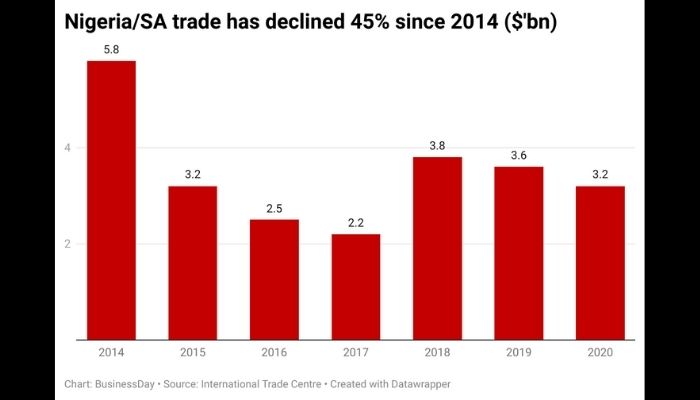

This, combined with persistent xenophobic attacks against Nigerians in South Africa and the inability of Nigerian companies to enter the South African market, has further exacerbated political and economic tensions between the two countries.

Nigeria and South Africa account for nearly a third of Africa's economic power and have driven much of the continent's conflict management efforts over the past 25 years. Both account for at least 60% of the economy of their respective subregions on the continent.

South Africa has emerged as a top investor in many sectors of the Nigerian economy. South African companies have a significant presence in the Nigerian economy, particularly in sectors such as telecommunications, engineering, banking, retail, hospitality, real estate development, construction and tourism.

MTN is Nigeria's largest telecommunications company. After MTN successfully entered the Nigerian market in 2001, many other South African companies followed suit, including Standard Bank (trading as Stanbic in Nigeria). Rand Merchant Bank is involved in the equity financing transaction.

In a 2012 report, Dawn Naggar and Mark Patterson of the Center for Dispute Resolution in Cape Town said: “Within three years of entering the Nigerian market, which is three times the size of South Africa, MTN “They were making more money in Nigeria than they were in Nigeria.” .

In 2003-2004, MTN Nigeria's profit after tax was R2.36 billion, higher than MTN South Africa's profit of R2.24 billion. MTN's phenomenal success has encouraged other South African companies to enter the Nigerian market. Within his first year in business, Stanbic's Nigerian affiliate contributed 13 per cent of the parent company's overall African revenue (R1.26 billion). ”

In 2008, Alexander Forbes bought a 40% stake in Nigeria's pension sector, which potentially covers 8 million civil servants, according to the report. “South Africa's Protea Group had four hotels operating in Lagos by the end of the year, with eight more under construction.” Fast food chains Chicken Licken and Debonairs Pizza have opened franchises in Nigeria.

SABMiller operates a brewery and is building another. South African media company Johncom has opened New Metro Cinema and multimedia stores in Abuja and Lagos, as well as a DVD and CD manufacturing plant.

Satellite TV provider Multichoice boasted 700,000 Nigerian customers in 2012 and spent $100 million developing local content.

Retailer Shoprite Checkers opened an outlet in Lagos in 2005 and was profitable within a year. ”

Economic relations between the two countries are important to the continent. Nigeria and South Africa are critical to the success of the African Continental Free Trade Area (AfCFTA).

South African President Cyril Ramaphosa said last year that the AfCFTA would foster regional value chains that would boost intra-African trade, foster industrialization and competitiveness, contribute to job creation, and facilitate Africa's meaningful integration into the global economy. He said he would release him.

The AfCFTA is expected to improve Africa's prospects as an attractive investment destination.

Related article: Nigeria and South Africa have obligations to black people – Oyebode

Nigeria does not have much trade with other African countries, making the AfCFTA a perfect opportunity to increase trade, grow the economy and bring about development.

As the European Center for Development Policy and Management pointed out in a recent discussion paper, “Nigeria and South Africa are not the only actors influencing the AfCFTA. Many other African countries and leaders also played important roles during the AfCFTA negotiations. I have fulfilled my goal.

Nevertheless, Nigeria and South Africa are particularly important to the success of AfCFTA for two related reasons. The first is purely economic. Nigeria and South Africa are Africa's two largest economies, together accounting for approximately one-third of the continent's gross domestic product. ”

The report states: “The size of their domestic markets also means that they account for a large proportion of intra-African trade. South Africa is by far the largest contributor to intra-African goods trade, accounting for just under a quarter of that. (24.9%), with Nigeria the third largest contributor (after Namibia), accounting for 5.51%.

It is clear that without these two African economic powerhouses, the benefits of an integrated continental market would be significantly reduced.

“The second reason why both countries are so important to the AfCFTA is because of their relative economic, military and diplomatic importance, as “turbulent powers'' (or “regional hegemons'') in regional and continental processes. It is something you can take action on.

Many countries claim to be Africa's battleground states, but few would dispute the claims of Nigeria and South Africa. Both have played important roles in the integration process of their respective regions. Both countries also exert influence at the continental level. ”