(Bloomberg) — SK Hynix posted a surprise operating profit and confirmed plans to build high-end memory capacity to meet AI demand, the latest indication of hopes for a long-delayed 2024 recovery. The contents were as follows.

Most Read Articles on Bloomberg

The world's second-largest memory chip maker reported an operating profit of 346 billion won ($259 million) in the December quarter, exceeding analysts' expectations for further losses and a 47% decline in sales. The company recorded its first operating profit in five quarters. However, the company's stock price fell 2% in Seoul, giving up some of the nearly 90% gain it gained in 2023.

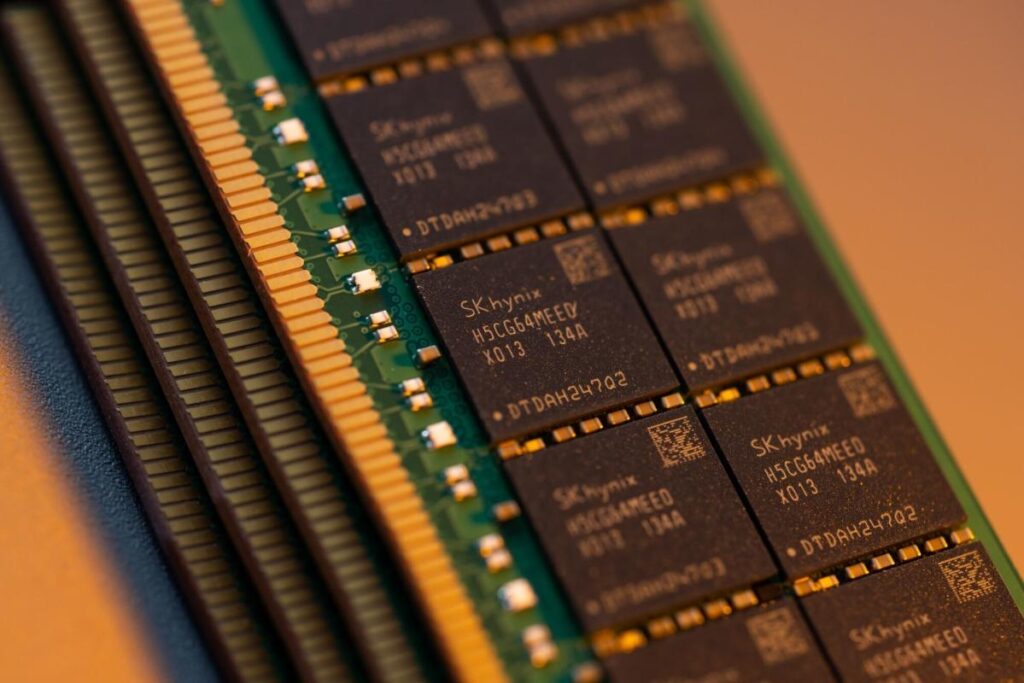

The company, which became South Korea's second most valuable company in December, is a leader in high-bandwidth memory chips that work in conjunction with Nvidia's AI accelerators, which are widely used for AI training. Investors are counting on generative AI to drive demand for servers that require more next-generation DRAM (DDR5).

Sanjeev Rana, an analyst at CLSA Securities Korea, said Hynix was the first company in the memory industry peer group to recover from a series of losses. “It is clear that continued improvement in our product mix with increased HBM contribution and overall recovery in commodity memory ASPs will continue to drive our revenue recovery in coming quarters.”

The company is considering producing DDR5 and LPDDR5, the latest generation of memory used in PCs and smartphones, at its Wuxi factory in China by shifting its production line to 10-nanometer-class products, a top financial official said. Director Kim Woo-hyun said this in a conference call. Thursday.

SK Hynix expects that DRAM inventory levels will normalize in the first half of this year, and that NAND inventories will follow as production cuts begin in the second half. NAND prices began to rise in the fourth quarter, the company said.

However, the prolonged recession continues to weigh on SK Hynix and its ability to invest aggressively. On a net basis, the company posted a larger-than-expected loss of 1.36 trillion won due to writedowns on its investment in Japanese semiconductor maker Kioxia.

“There was hope for a turnaround,” said Ahn Hyun-jin, chief executive officer and fund manager at Billionfold Asset Management. “SK Hynix could have done better.”

The memory maker made the announcement days after larger rival Samsung Electronics reported disappointing numbers, reflecting a weak semiconductor market that has depressed profit margins for more than a year. However, industry executives expect a gradual recovery starting in 2024, especially as AI development accelerates and more services leveraging new chip technology emerge.

Chipmakers are optimistic about the sector's recovery, with Taiwan Semiconductor Manufacturing Co. last week predicting strong sales growth in 2024. ASML Holding NV, the sole maker of high-end lithography equipment that is key to manufacturing the most sophisticated semiconductors, closed at a record high on Wednesday. Orders more than tripled last quarter.

According to SK Hynix, smartphones and PCs equipped with AI are boosting demand for chips. The company plans to increase overall capital spending in 2024 while continuing to reduce production of legacy chips. The company will focus on investing in high-bandwidth memory and other strategic products, and will proceed with mass production of its AI memory product HBM3E.

Read more: Samsung's profits drop 35% as chip vulnerabilities persist

The company said HBM3 sales soared more than five times in the fourth quarter, while DDR5 chip sales more than quadrupled. SK Hynix currently expects demand for both DRAM and NAND to increase at a rate of mid-to-high 10% in 2024, which is consistent with predictions that the market will recover this year. .

“It's a surprise for the entire market,” said Baik Gilhyun, an analyst at Korea Yuanta Securities. This result reflects a recovery in demand not only in AI-related fields, but also in the smartphone and PC markets as a whole, he said.

–With assistance from Youkyung Lee and Vlad Savov.

(Updates stock price reaction, investor comments, and management comments on earnings announcements.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP