The 2024 budget released this week highlights the poor financial position the government is in, with the government still facing a R150 billion gold and foreign exchange contingency reserve account. This is concerning because it appears to be the only pot of gold. can be accessed.

It is common in countries around the world to use foreign currency profits, but withdrawals must be used effectively.

advertisement

Continue reading below

The use of R150 billion will provide temporary relief, but it will be wasted if the core structural problems that have led to the country's debt rising to this extent are not effectively addressed. Consider electricity supply, logistics, corruption, and poor financial management of governments, national institutions, and local governments.

Read: #Budget2024 in a nutshell: No major tax increases

South Africa needs a legislative debt ceiling to limit the amount of debt the country can absorb.

Investment group Charles Schwab emphasizes that only a few countries have such caps.

These include the United States, Denmark, Poland, Kenya, Malaysia, Namibia, and Pakistan. The US and Denmark have absolute caps, meaning their debt cannot exceed a certain amount. The upper limit for other countries is as a percentage of GDP.

| Countries with debt ceilings | sealing |

| united states of america | Fixed amount of $31.4 trillion |

| Denmark | Fixed amount is $180 billion |

| Poland | Limit spending to 60% of GDP |

| kenya | 55% of GDP |

| Malaysia | 66% of GDP |

| Namibia | 35% of GDP (current ratio is 72%) |

| Pakistan | 60% of GDP (current ratio is 75%) |

Apart from Denmark, many other countries do not seem to be sticking to the cap, but at least providing a target.

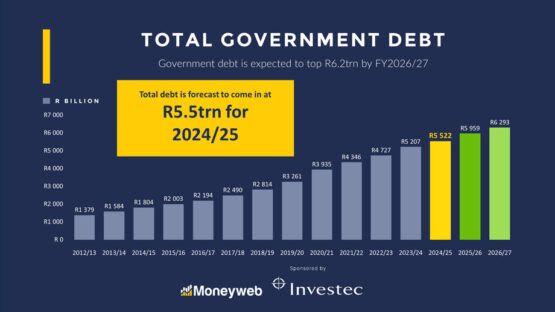

South Africa's debt currently stands at around R5.2 trillion, or 74% of GDP, but with one in every five rands of revenue spent on interest payments, it is already beyond repayment.

Source: National Treasury

Debt is set to rise to R6.3 trillion by 2027, equivalent to 75% of GDP, which Treasury says is the level at which the ratio will stabilize before falling.

History suggests that is unlikely.

advertisement

Continue reading below

When Cyril Ramaphosa became president in 2018, South Africa's debt stood at R2.3 trillion, or 49% of GDP.

At the time, we predicted that the national treasury would stabilize at 53% in 2024, but this was a surprise.

While coronavirus has certainly had an impact, it still means South Africa's debt has soared by 126% in just six years, reflecting the severity of the problem.

A recent study by the World Bank suggests that the maximum threshold for developing countries is around 64%. When this ratio gets high, it starts to have a negative impact on economic growth.

It would be appropriate for South Africa to set a debt ceiling at around 64% of GDP and develop a roadmap to achieve this goal.

That could only happen by taking the unpopular decision to privatize underperforming state-owned enterprises such as Eskom and Transnet and use the proceeds to pay down debt.

Perhaps it's wishful thinking, but if current trends continue, the fiscal cliff will be approaching sooner than we think.