South African household consumption likely grew at its weakest pace in 30 years last year, excluding the global financial crisis and COVID-19 lockdown, but is likely to grow by 2024, according to research from HSBC Global Research. A slight recovery is expected in 2020.

Analysts led by David Faulkner said in a report that they expect consumer spending to grow at a below-trend 1.1% this year, compared with an expected 0.7% in 2023.

advertisement

Continue reading below

Read: Sisa Nyama index shows SA food inflation may have peaked

“While the consumer outlook remains challenging, we believe there is scope for household finances to strengthen as 2024 progresses, having struggled so much last year,” the analysts wrote.

Amid sluggish economic growth, household consumption is being held back by persistent inflation, rising interest rates and a weak labor market recovery.

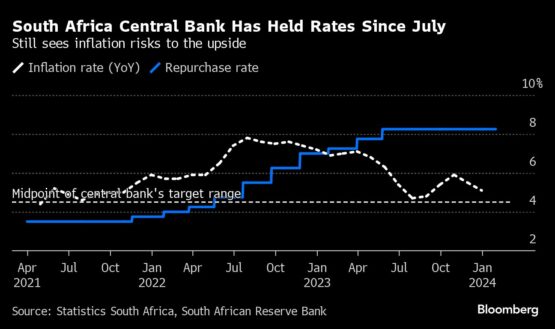

South African Reserve Bank policymakers are reluctant to cut interest rates, which they kept at 8.25% at last week's meeting, saying they will not act until they see convincing evidence that price pressures are sustainably moving towards their target. Stated.

HSBC analysts don't expect this scenario to change anytime soon. They predict that inflation will average 5.3% this year, 5.9% in 2023 and 5.1% in 2025, with poor households once again facing higher food price increases.

Read: Sarb keeps repo rate stable at 8.25%

“With this backdrop of price growth and rising inflation expectations, we believe there is little scope for significant policy easing this year, and we believe there is little room for significant policy easing this year, and we believe that sustained inflation will continue to grow towards 4.5%, the desired midpoint of our target range. Saab is likely to remain cautious until we see a downward trend,'' they said. “This will limit the reduction in debt servicing costs, which rose to R400 billion ($21 billion) annually in the third quarter, equivalent to 9% of disposable income.” This could increase by around R30 billion this year.

Because of these pressures, analysts don't expect the central bank to start lowering its benchmark policy rate until September.

advertisement

Continue reading below

Still, they predicted that the recently extended R350 monthly benefit for poor households, introduced during the coronavirus pandemic and running until March 2025, would “continue to support household spending at the lower end of the income distribution”. are doing. It will be more generous ahead of national elections. ”

Read: Inflation falls to 5.1% in December

South Africa will hold elections this year, and all eyes will be on whether Finance Minister Enoch Godongwana, who will announce his annual budget statement in Cape Town on February 21, will take a generous stance before the vote.

He said the country needed to live within its means, but loosened national funding as opinion polls showed the ruling African National Congress was at risk of losing its majority for the first time since late 2016. He said he was facing pressure from other parts of the government. It was ruled by a white minority in 1994.

“Election-related uncertainty could also limit the scope for stronger sentiment as consumers weigh political risks,” the analysts warned.

© 2024 Bloomberg