Lenders to TotalEnergies SE's Mozambique liquefied natural gas project are considering raising billions of dollars in financing as the company plans to restart construction three years after development was halted by Islamic militant attacks. ing.

An onshore facility planned to export the southern African nation's major gas discovery has attracted the biggest project funding ever seen in Africa. That was before Total evacuated its employees and declared force majeure after an Islamic State-linked extremist attack occurred nearby in 2021.

advertisement

Continue reading below

They said the U.S. Export-Import Bank, which pledged the largest loan of $4.7 billion, and other financial institutions with total debt of about $15 billion, were evaluating whether to resume funding. TotalEnergies CEO Patrick Pouyanne said last month that the company was working with suppliers and contractors to make progress towards a mid-year restart. He had previously targeted the end of 2023.

“Export-Import will continue to work with its financing partners and borrowers to conduct due diligence on the Mozambique LNG project in connection with the proposed project and resume amendments to the financial statements,” the U.S. Export-Import Bank said in response to questions. answered and stated. Due to force majeure, no payment has been made.

The Biden administration's decision to suspend approval of new export permits for liquefied natural gas in January, recognizing that the climate impact of fossil fuels must be reassessed to assess whether to resume financing. I went at the same time. U.S. Export-Import Bank financing for the Mozambique project was first provided in 2020 under the administration of former President Donald Trump.

Exports and imports will comply with Biden's climate change agenda “while complying with legal requirements for imports and exports, including the Charter prohibition on discrimination based solely on industry, sector, or business, and imports and exports' mandate to support American jobs.” He said they aim to work together, adding that he would like to see any changes to the charter. Congressional action is needed.

recurrent violence

Russia's invasion of Ukraine has plunged Europe into a scramble for alternative energy supplies, and interest in future LNG production is increasing, but projects in African countries are still affected by various problems such as political instability and construction delays. Cheap. In Mozambique, Islamic fighters continue to carry out sporadic and deadly attacks, but there is the added hurdle of an uprising that has been crushed by armed groups.

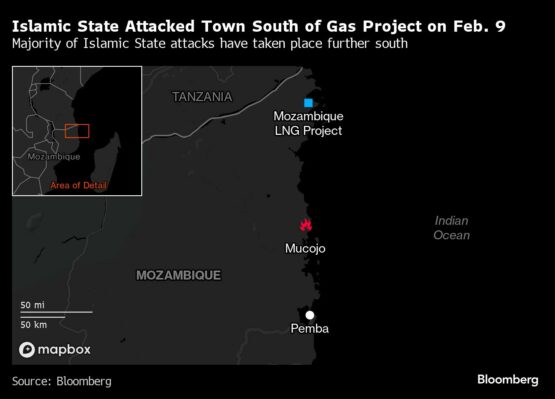

The series of attacks since December marks a resurgence in violence after Mozambican and regional forces announced last year a major victory in a six-year conflict that has left around 5,000 people dead. The worst recent attack took place about 136 kilometers (85 miles) south of the LNG project, with subsequent attacks occurring further afield.

More than 70,000 people have been forcibly displaced in Cabo Delgado since violence and attacks against civilians broke out in early February, the United Nations refugee agency said in a statement Friday.

advertisement

Continue reading below

Amsterdam-based Dutch export credit agency Atradius Dutch State Business, which has pledged $1 billion for Mozambique LNG, also said it was assessing the situation. “Due diligence is currently underway to assess whether a drawdown under the loan can be granted.”

In October, Mozambique's Finance Minister Max Tonella called on relevant export credit agencies to recommit loans by the end of last year.

Both the Export-Import Bank of the United States and Atradius declined to provide a timeline for when the evaluation would be completed.

U.S. financiers had long known about the rebellion that ultimately canceled the project. Independent analysis pointed to security risks even before the loan was approved.

Regarding the continuing violence, Export-Import said all transactions are “subject to strict statutory and policy requirements of the agency, including feasibility studies and consistency with import-export financial, technical, environmental and social due diligence procedures and guidelines.” We are undergoing due diligence.”

© 2024 Bloomberg