The global economic and financial outlook has improved over the past six months. Inflation is falling, financial conditions are easing, and risks to the outlook are balanced. However, many countries continue to struggle with high levels of public debt and fiscal deficits, amid new challenges from high real interest rates and bleak medium-term growth prospects.

Our latest fiscal monitor calls on governments to avoid fiscal slippage and increase their focus on rebuilding buffers and ensuring medium-term fiscal sustainability.

Fiscal policy took a more expansionary turn last year after debt and deficits improved rapidly over the past two years. Only half of the world's economies tightened fiscal policy last year, down from around 70% in 2022.

Four years after the start of the pandemic, public spending, excluding interest payments, is about 3 percentage points of gross domestic product (GDP) above pre-pandemic projections in developed countries, excluding the United States, and in emerging markets, excluding China. This is a 2 percentage point increase. . This level of spending reflects the gradual easing of fiscal policy during the crisis and the introduction of new support measures, along with new industrial policy measures such as subsidies and tax breaks. The increase in nominal interest rates has led to an increase in interest payments in most countries.

Global public debt will rise to 93% of GDP in 2023, remaining 9 percentage points above pre-pandemic levels. This increase was led by the United States and China, the two largest economies, with debt increasing by more than 2 and 6 percentage points of GDP, respectively.

These two economies also shape global financial trends and prospects. Slowing growth in China could weigh on global growth and trade and pose fiscal challenges for countries with strong trade and investment ties. If U.S. bond yields are high and volatile, financing conditions will become tighter in other countries around the world.

Although gradual fiscal tightening is expected to resume this year, significant uncertainty remains.

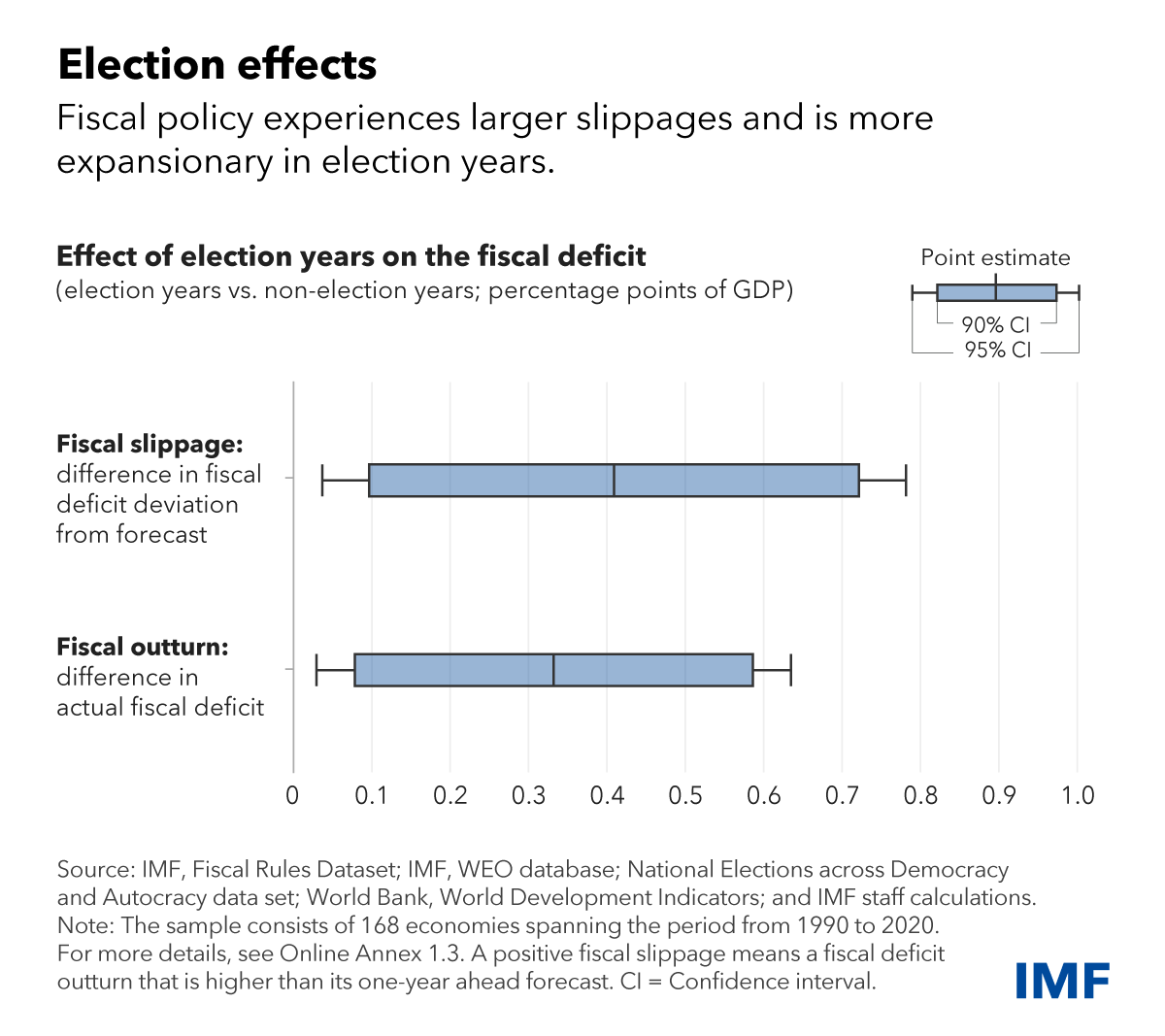

In 2024, national elections will be held in a record number of countries, home to more than half of the world's population. Historically, governments tend to increase spending and reduce taxes in election years. Budget deficits in election years tend to exceed forecasts by 0.4 percentage points of GDP compared to non-election years. In this great election year, the government needs to exercise fiscal restraint to maintain fiscal health.

We expect moderate fiscal tightening in the medium term, but this will not be enough to stabilize public debt in many countries. Our chapter shows that under current policies, primary budget deficits excluding interest costs are This indicates that debt will remain above the stable debt level in 2029. The magnitude of further adjustments required varies. The amount needed to reduce average primary deficits is particularly large for emerging economies, as our projections show rising public debt-to-GDP ratios. We estimate this to be 2.1 percentage points of GDP. The country group in this paragraph aptly summarizes her two largest economic powers: the United States and China.

Without further efforts, it could take years to return fiscal policy to its pre-pandemic normal. Spending pressures to address structural challenges such as demographics and the green transition have become more pressing, while weaker medium-term growth prospects and high real interest rates will further constrain fiscal space in most countries. There is a high possibility that it will be done.

Countries need determined efforts to protect sustainable public finances and rebuild fiscal buffers. The pace of fiscal consolidation should be adjusted according to the fiscal risks and macroeconomic conditions each country faces. Countries need to act decisively when sovereign risks rise and fiscal credibility is lacking.

Governments should immediately phase out the legacy of crisis-era fiscal policies, including energy subsidies, and pursue reforms to limit spending growth while protecting the most vulnerable. Developed countries with aging populations need to curb spending pressures on health and pensions through entitlement reform and other measures.

Revenues must keep up with expenses over time. In developed countries, targeting excess profits as part of corporate tax systems could further boost revenue. Emerging market and developing countries can increase their tax revenue potential by broadening their tax base, improving tax system design, and strengthening revenue management. Our research shows that such measures could, in ideal circumstances, lead to as much as an additional 9% increase in GDP.

The foundation for sound and sustainable public finances requires a medium-term approach to budget planning and execution.all countries can benefit from Improving fiscal transparency and increasing the use of emerging technologies known as GovTech. Orderly and timely debt restructuring is important for countries experiencing severe debt crises. Continued international cooperation, such as through the Group of 20 Common Framework and the World Sovereign Debt Roundtable, is essential to foster an efficient debt restructuring process.

—This blog is based on Chapter 1. April 2024 Financial Monitor.